Condo Insurance in and around Montgomery

Looking for great condo unitowners insurance in Montgomery?

Insure your condo with State Farm today

Condo Sweet Condo Starts With State Farm

Because your condo is your retreat, there are some key details to consider - future needs, neighborhood, home layout, and making sure you have the right protection for your home in case of the unexpected. That's where State Farm comes in to offer you excellent coverage options to help meet your needs.

Looking for great condo unitowners insurance in Montgomery?

Insure your condo with State Farm today

Put Those Worries To Rest

With this coverage from State Farm, you don't have to be afraid of the unexpected happening to your condo and its contents. Agent Shane Anderson can help inform you of all the various options for you to consider, and will assist you in building an excellent policy that's right for you.

Finding the right protection for your condo is made simple with State Farm. There is no better time than today to reach out to agent Shane Anderson and explore more about your wonderful options.

Have More Questions About Condo Unitowners Insurance?

Call Shane at (334) 396-8808 or visit our FAQ page.

Simple Insights®

Appliance maintenance to-dos for your home

Appliance maintenance to-dos for your home

Regular upkeep of all of your home’s appliances and big systems is a must-do that ensures these investments work well and have long, productive lives.

House hunting

House hunting

House hunting can be a time-consuming process, but with some research and foresight, you may be able to avoid wasted time and expensive risks.

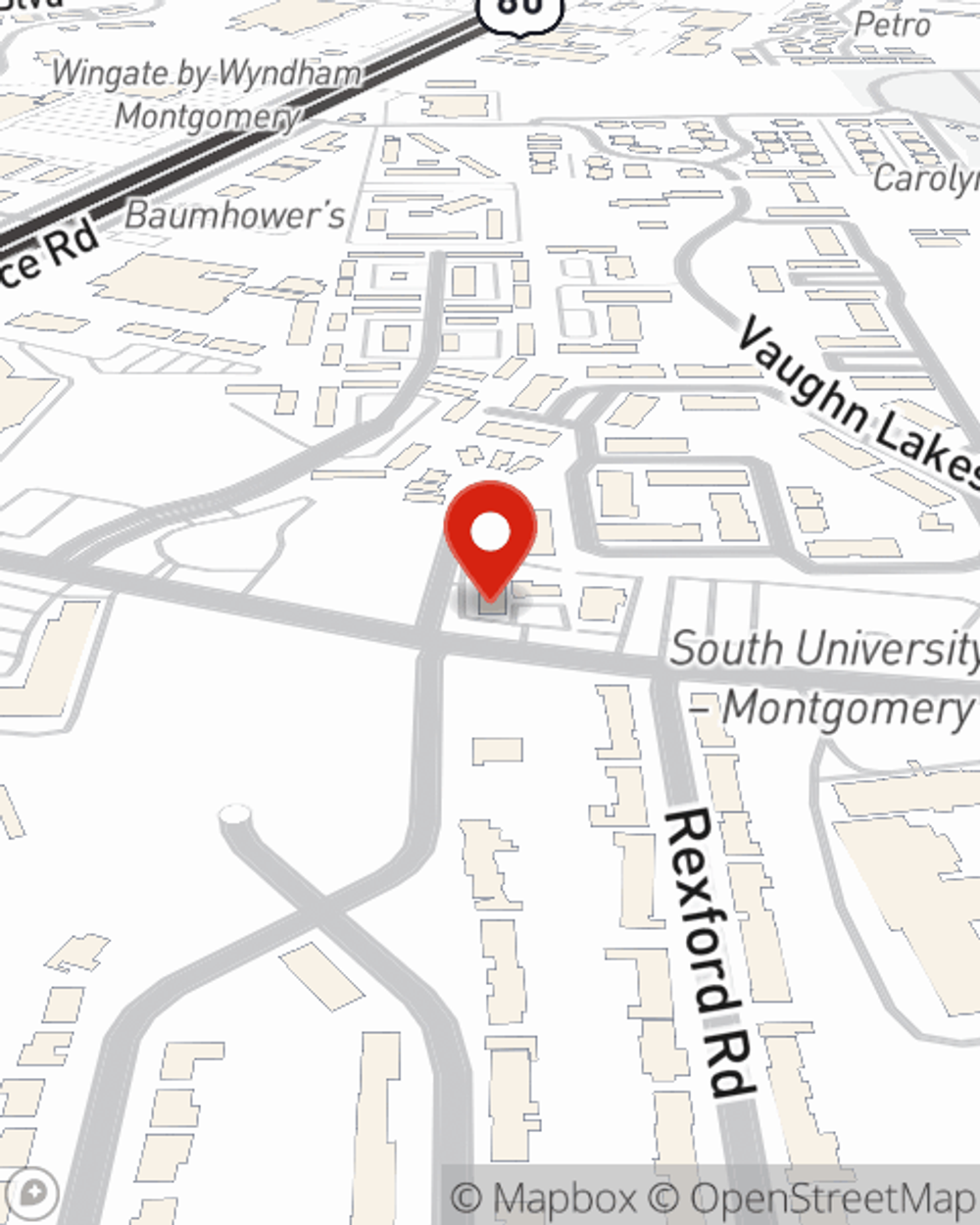

Shane Anderson

State Farm® Insurance AgentSimple Insights®

Appliance maintenance to-dos for your home

Appliance maintenance to-dos for your home

Regular upkeep of all of your home’s appliances and big systems is a must-do that ensures these investments work well and have long, productive lives.

House hunting

House hunting

House hunting can be a time-consuming process, but with some research and foresight, you may be able to avoid wasted time and expensive risks.